Mark Employees Exempt from FICA, FUTA, and SUI Taxes in Payroll

You can now mark employees exempt from FICA, FUTA, SUI taxes on the Employee > Tax page of their Payroll profile—no need to submit a Service request.

OVERVIEW

Employees working on certain international visas (and their employers) may not be obligated to pay FICA, FUTA, and SUI taxes. We've added the ability to mark an employee (and employer) exempt from these taxes on the employee's Employee > Tax profile page in Namely Payroll.

-

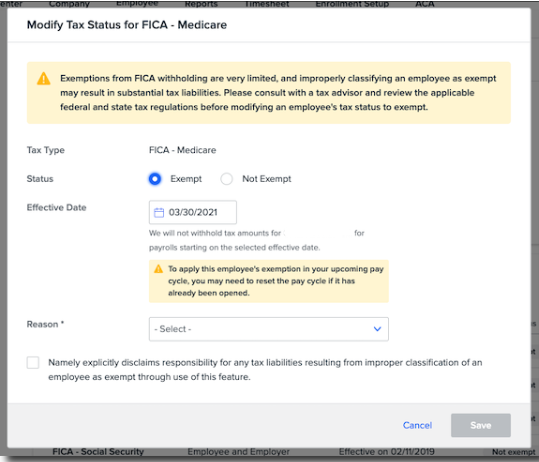

Note: Exemptions from FICA withholding are very limited, and improperly classifying an employee as exempt may result in substantial tax liabilities. Please consult with a tax advisor and review the applicable federal and state tax regulations before modifying an employee's tax status to exempt. Namely explicitly disclaims responsibility for any tax liabilities resulting from improper classification of an employee as exempt through use of this feature.

ACCESS

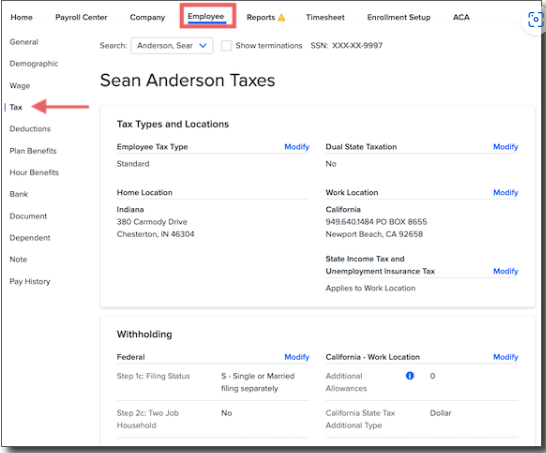

To access an employee's taxes:

-

In Namely Payroll, click Employee.

-

Search for the employee's name or select it from the employee list.

-

Click Tax.

MARKING AN EMPLOYEE EXEMPT

-

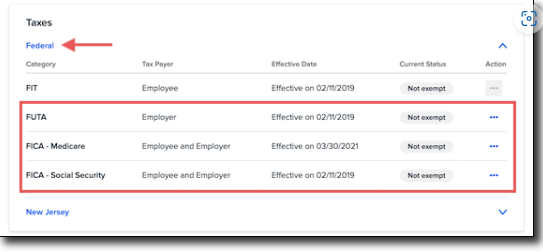

FICA Medicare and Social Security taxes are paid by both the employee and employer, and both portions of the tax must be marked exempt for any employees who are not obligated to pay. As such, both portions are grouped together as a single tax.

-

FICA and FUTA taxes can be found under the Federal section of the employee's Taxes section.

-

SUI taxes can be found under the specific state's section.

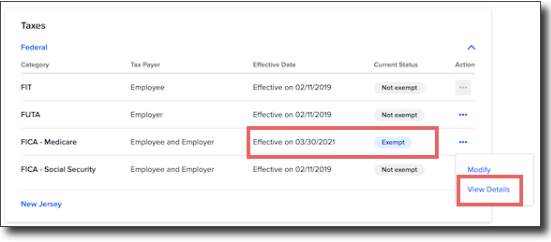

The Taxes section displays the Category of the tax, the Tax Payer (Employee, Employer, or both), the tax's Effective Date, and its current exemption Status.

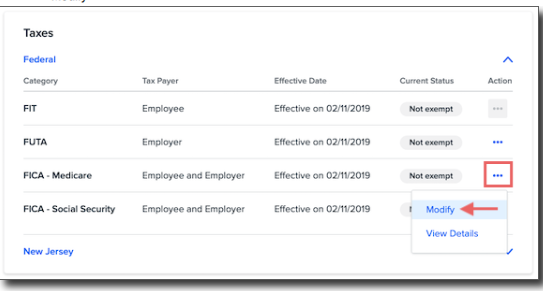

To mark an employee and employer exempt any taxes:

-

Click the Action menu next to the tax.

-

Select Modify.

-

Select Exempt for the status.

-

Select an Effective Date on which the tax's status should change.

-

Note: If you have an upcoming pay cycle that has already been opened, you may need to reset the cycle to apply the employee's exemption to it.

-

TIP:

If the effective date is in the past, submit a case in the Help Community and a Pod Service Consultant will assist with the corrections and adjustments to the exemption accordingly.

-

Select a Reason that the employee is exempt.

-

Select the checkbox to acknowledge that Namely explicitly disclaims responsibility for any tax liabilities resulting from improper classification of an employee as exempt through use of this feature.

-

Click Save.

Once saved, the employee's Current Status will change, along with the Effective Date for that change.

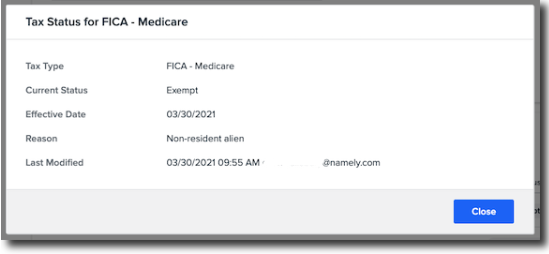

Click View Details for more information on the most recent change made to the tax, including the time it was modified and who modified it (redacted in screenshot below).